Examining the terrible economics of food delivery.

By: Tony Yiu Data scientist. 26K Followers Founder Alpha Beta Blog.

A few months ago, I rode along with my girlfriend as she made a few DoorDash deliveries. She had always wanted to try being a Dasher and we thought it might be a cool way to spend a few hours exploring San Francisco on a weekend afternoon.

Over a three hour span, we made five deliveries, including one that took 30 minutes to drive to. All in all, I think we made around $28. One thing that surprised me was that almost none of it came from tips.

Then again, maybe it’s not that surprising. From the customers’ perspective, they are already paying more for their order than they would have if they had actually gone to the restaurant (because restaurants tend to increase their prices to counter food delivery app fees). On top of the higher price, DoorDash adds a slew of fees. For example, I wanted to see how much it would cost me to have a burger delivered and got the charges in the picture to the left.

The total for the order would have been $26.19 for a $9 burger! And the fees are confusing as well — many customers see a Delivery Fee and probably assume that it includes some tip already. And someone paying almost 3X for a burger is understandably in no mood to be handing out additional tips.

On the other side sits the Dashers who drive through tons of traffic, are often forced to illegally park (and get yelled at), and are putting themselves at significant risk of contracting COVID in order to deliver the customer’s food. They believe that they deserve a tip, and they definitely do.

There’s also the restaurant. They feel gouged by DoorDash’s commission and are often forced to raise prices to make a reasonable margin.

And finally there’s DoorDash, which reported a $436 million loss for the year ended 12/31/2020 (note that this loss includes the COVID boost to its top line revenues).

Where Does All The Money Go?

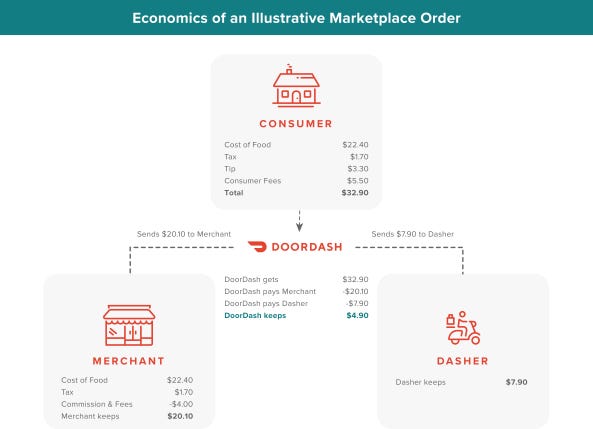

All this begs the question — if everyone feels ripped off, and DoorDash is not able to turn a profit either, where is all the money going? In the example transaction that DoorDash included in their S1, the breakout of the total pie is as follows:

- Restaurant (merchant) gets approximately 60% of the total $32.90.

- The Dasher gets around 25%.

- And DoorDash gets 15%.

Source: DoorDash S1

DoorDash doesn’t go into the details of how to calculate the Dasher’s pay besides that it’s based on a proprietary algorithm, and that 100% of any tip is passed on to the Dasher. But going by what they say in their S1, we can break things out another way:

Based on its illustrative translation, DoorDash sometimes keeps more for itself than it pays to Dashers

A few things jump out to me when we reframe the transaction this way:

- DoorDash keeps more for itself than it pays to the Dasher. So without tips (which are highly variable because customers don’t like to pay tips due to feeling ripped off by all the fees), the Dasher makes peanuts. And there was a time when DoorDash used tips to minimize what it paid out to Dashers (i.e. the Dasher gets a fixed amount so if I tip more, then DoorDash pays the Dasher less).

- If we look at the $27.90 (net of tip and tax) as the total splittable amount, the pie breaks down as: Restaurant gets 66%, Dasher gets 16%, DoorDash gets 18%.

When I Googled, it seems like a take rate of 15% to 20% is standard for service platforms like Uber, Airbnb, and DoorDash. So DoorDash doesn’t look uniquely greedy, just generally so.

But it’s surprising that the people doing the bulk of the work get paid the least. Then again, if you rank the order of importance of the players in DoorDash’s food delivery ecosystem, it’s not that surprising.

First are the customers. DoorDash needs customer growth in order to justify and keep increasing its valuation (which allows it to retain and attract investors and software engineers) — no customers, no company. Second are the restaurants. Having a wide range of desirable food options is critical to both maintaining its customer base and growing it. It’s worth noting that the recent influx of ghost kitchens (delivery only “restaurants”) has increased the supply of food options and likely reduced the bargaining power of traditional restaurants.

Next DoorDash pays itself. It needs a lot of money to pay software engineers to maintain and improve its platform, pay Amazon for cloud infrastructure, and pay the marketing expenses needed to attract new users and stave off competitors.

Last on that list are Dashers. They will never say this publicly, but I believe that service platforms like Uber and DoorDash view their delivery folks as both a cost to be minimized and as commodities that can be easily replaced. Customers and to a lesser extant restaurants are valued because of their impact on Customer Lifetime Value and the feedback loop that drives DoorDash’s business (more customers attracts more restaurants which attracts even more customers and so on).

Moreover, DoorDash can’t really raise prices on customers or fees on restaurants as they are already high and it risks pushing them into the hands of the competition. Instead, DoorDash aims to drive revenue and margin growth by pushing down expenses of which Dashers are a major component. Cheaper Dashers means cheaper food and more users and orders-per-user.

The Flawed Flywheel

Source: DoorDash S1

Ironically, DoorDash does include Dashers on its “flywheel”. But its flywheel is not a true flywheel. In a true flywheel, all the components benefit when the number of any individual component increases. More of everything else benefits consumers because it means more restaurants to choose from (in terms of price and cuisine) and both faster and cheaper fulfillment (due to there being more Dashers). For merchants, more consumers and Dashers leads directly to more business.

What about for Dashers? More consumers and restaurants might lead to more work opportunities — but it could also very likely lead to lower pay on a per-job basis (especially if DoorDash is primarily committed to meeting some minimum per-hour wage). The real reason DoorDash wants more drivers (besides faster fulfillment) is to push down Dasher pay. Dasher pay is primarily variable (as they are paid per job as opposed to earning a salary). Thus, if the number of Dashers serving an area grows faster than the number of transactions, supply and demand dictates that Dasher pay should decline. This is great for customers, restaurants, and DoorDash’s revenues and margins; but not good at all for Dashers.

DoorDash, like Uber, seems to be a business with inherently flawed economics. Both companies (and others like them) are incentivized to maximize shareholder value by exploiting and driving down the pay and benefits of the folks who do all the actual work.